So here we are, double dip recession, slow growth, debt & deficit going up. Yes yes the rest of the world isn’t doing too great either, even China is slowing down… but we seem to be doing much worse. Why?

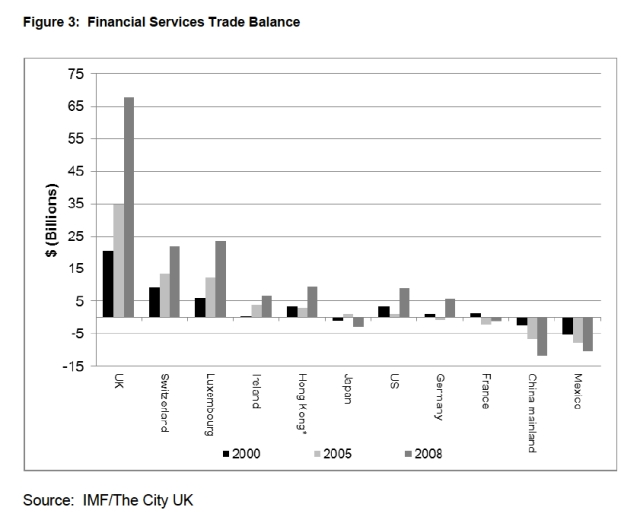

First, how did we get here? You hear politicians talk about our “unbalanced economy” – too much emphasis given to financial services etc and not enough to manufacturing, high tech etc. Long time followers of mine know I love stats & charts, so here is what it looks like:

So what you say, must be good for the country right? Yes lots of tax for the Treasury to throw around. The significant growth of the financial services sector and light touch regulation also combined to provide lots of easy credit for us plebs. Great! Fabulous! “Please lend me more & more Mr Bank Manager & Mrs Building Society, it may be 9 times income for the 105% mortgage but boom & bust had been abolished (someone once said)”…

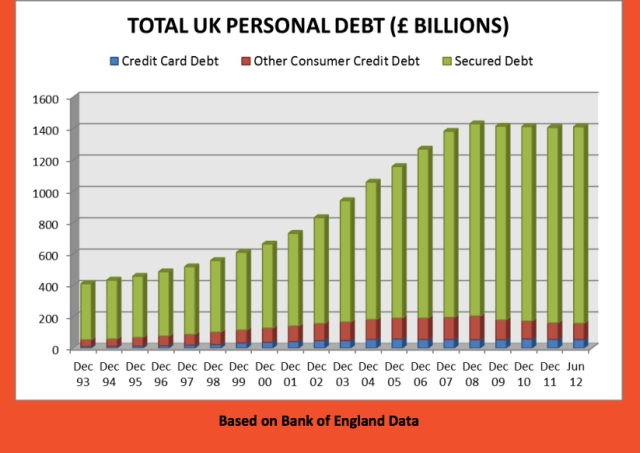

But easy credit leads to bubbles, perhaps, just maybe? What do you think? What DID our politicians think? Or thought but didn’t care. Well here are the bubbles in personal credit & property:

So what you say, everyone else was borrowing, the boom & bust had been abolished. Yes but no but yes but here is what people of other countries were borrowing (including government, personal & company):

Yes, our total borrowing is about £8 TRILLION or 500% of GDP. Yes, that’s 5 times what this country produces every year.

So why aren’t we spending and pushing up GDP? If you look at the personal debt chart above, you can see we are “deleveraging” – paying down all kinds of debt. Companies are too.

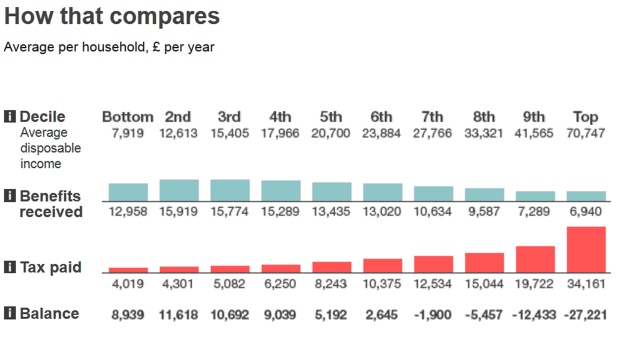

Here is a chart to give the national picture:

That’s not too bad, is it? Well hold on a minute, the debt is now past the £1TN mark and is still going up. We pay more debt interest than we spend on defence. And we mustn’t forget those lovely off-balance sheet PFI projects. Compare the capital costs with the huge repayments below:

We, as in the country, UK companies & population collectively owe more than any other country in the world bar Japan (which has been in stagnation for decades).

PriceWaterhouseCoopers reckon the total UK debt will hit £10 TRILLION by 2015. That’s optimistic.

Just to whet your appetite for another blog post in the pipeline, we also have a public sector pension black hole of about £1.3TRILLION, there’s a chart for that 🙂

The above is a quick illustration of the primary reasons why we are in the collective shite compared to other G20 countries. (Oh yes, I used 6 charts instead of 4, got carried away with chart porn. Bet you didn’t notice)

Government now wants us to spend, spend, spend, and borrow ££ to spend if necessary to improve GDP growth figures … No thank you Mr Prime Minister. That is how we got here in the first place.